Unpacking SCHD Stock: Your Guide To Schwab's Dividend ETF For Income

Thinking about growing your investment income? Then, very often, you might hear talk about a fund called SCHD. This particular exchange-traded fund, or ETF, has become quite a favorite for folks looking to get regular payments from their investments. It is a bit like a special basket of stocks, picked out for their ability to pay dividends, which are basically portions of a company's earnings given back to shareholders. Knowing more about SCHD stock can really help you decide if it fits with your money goals.

This fund, the Schwab U.S. Dividend Equity ETF, aims to give you a similar return to a specific group of dividend-paying companies. It's designed to track the performance of the Dow Jones U.S. Dividend 100 Index, which, you know, includes 100 leading dividend stocks. For many, this ETF offers a way to get a piece of many good companies without having to pick each one individually, which is pretty convenient.

Whether you are just starting out with investing or you have been at it for a while, getting a good grip on what SCHD offers can be very useful. It’s about understanding its parts, how it has performed, and what kind of income it might provide. So, let’s explore what makes SCHD stock a topic of interest for so many people who want to build up their financial future.

- Shaka Smart

- Entwine Cocktail Bar

- Easy Nail Art Designs

- Almost Monday Merch

- Fort Lauderdale Weather Hour By Hour

Table of Contents

- What is SCHD Stock?

- How SCHD Works and What It Aims to Do

- Performance and History of SCHD

- What SCHD Holds: Its Components

- SCHD for Passive Income Investors

- Recent Happenings with SCHD

- Frequently Asked Questions About SCHD Stock

- Making a Decision About SCHD Stock

What is SCHD Stock?

When people talk about SCHD stock, they are referring to the Schwab U.S. Dividend Equity ETF. This fund, managed by Charles Schwab Investment Management, Inc., is a kind of investment product that holds a collection of stocks. Its main idea, you know, is to give investors exposure to companies that have a strong track record of paying out dividends, which are regular cash payments to shareholders. It’s a way for you to own a piece of many such companies all at once.

You can find the latest information on SCHD, including its current price and how it has done over time, from various financial news sources. These places often provide a lot of vital information to help you with your stock trading and investing plans. It's really helpful to check these details before making any moves, so you are well-informed.

How SCHD Works and What It Aims to Do

The main objective of the Schwab U.S. Dividend Equity ETF is to follow, as closely as it can, the overall return of the Dow Jones U.S. Dividend 100 Index. This means it tries to buy and hold the same stocks, in roughly the same proportions, as that index. So, if that index goes up, SCHD, very typically, tries to go up with it, and the same for going down. This tracking goal is a key part of how the fund operates, before any fees or costs are taken out.

You can get a full overview of this ETF from financial sites, which usually show its structure and how it works as an exchange-traded fund. These sites also help you view its current price and any breaking news related to it. This information is, you know, quite important for making better decisions when you are investing in ETFs.

Tracking SCHD's price, its past values, and other financial details can help you on your investing journey. Some financial platforms even offer insights and price predictions, which can be, you know, quite interesting to look at. It's all about getting as much data as you can to feel good about your choices.

Performance and History of SCHD

Looking at how SCHD has performed over time is a common step for many investors. Fund details often include its past performance, which shows how it has grown or changed in value. This can give you a sense of its track record, though, of course, past results don't guarantee what will happen in the future. Still, it's a good starting point for your research.

You can often find interactive charts for SCHD, which let you analyze its data with a wide range of indicators. These tools allow you to see price movements, trading volumes, and other metrics that might help you understand its history better. It’s a pretty visual way to explore the fund’s journey over the years.

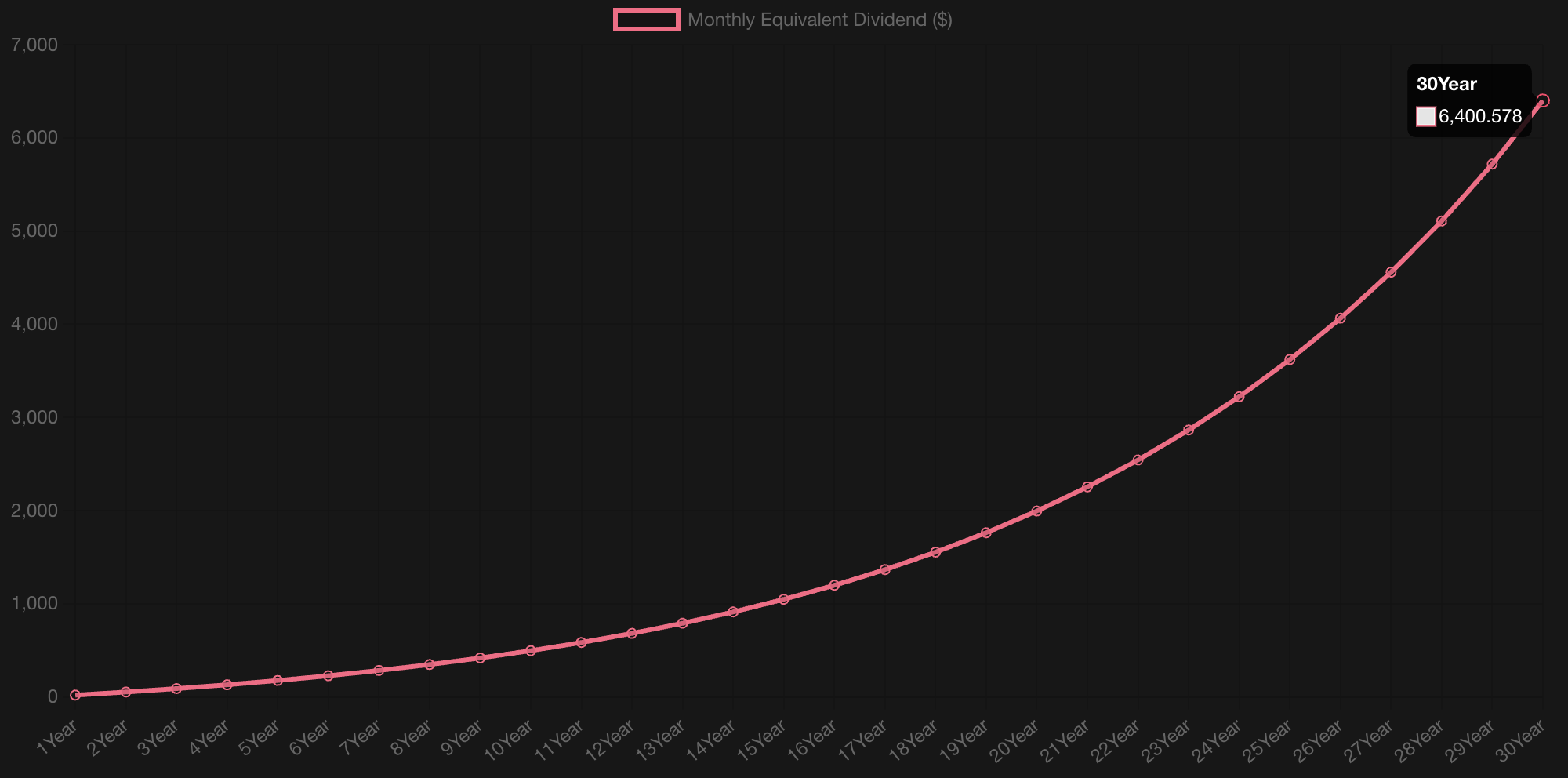

Getting the latest dividend information for SCHD is also straightforward. This includes its dividend history, which shows how much it has paid out over time, its current yield, and important dates related to its payments. Knowing these details can be, you know, really helpful for those who rely on investment income.

What SCHD Holds: Its Components

SCHD, like any ETF, is made up of many individual stocks. These are the companies that, you know, make up its "holdings." You can usually view a list of its top holdings and other key information about what the fund owns. This gives you a clear picture of the types of companies you are indirectly investing in when you buy SCHD.

A complete list of holdings for SCHD is often available, showing details about each stock and its percentage weighting within the ETF. This means you can see exactly which companies the fund invests in and how much of the fund’s total value each company represents. It's a bit like looking at the ingredients list for a recipe, so you know what's inside.

Recently, SCHD made some changes to its holdings, which is called rebalancing. This process added 20 new stocks, with a particular focus on sectors that tend to follow economic cycles, like energy and financial companies. This shows that the fund, you know, adjusts its composition periodically to keep in line with its index's rules and perhaps to capture new opportunities.

SCHD for Passive Income Investors

For people who are looking to get a steady stream of money from their investments, SCHD is often seen as one of the better ETF choices on the market. It's designed specifically with dividend-paying companies in mind, which makes it appealing for those who want to build up their passive income. The idea is that you buy the fund, and it, you know, regularly sends you dividend payments.

Reading why SCHD ETF is considered ideal for passive income investors can give you more insight. It's often highlighted for its focus on quality dividend stocks, which can provide a more reliable income stream. This is a big draw for folks who are saving for retirement or just want some extra cash flow from their investments.

However, it's also worth noting that SCHD is not as spread out as some other very broad market funds, like those that track the entire S&P 500 or the total stock market. While it holds many stocks, its focus on dividends means it might not include every type of company you would find in a broader fund. This is something to consider if you want the widest possible range of investments.

Recent Happenings with SCHD

As mentioned, SCHD's recent rebalancing brought in some new companies, especially those in cyclical sectors. This kind of adjustment is a normal part of how ETFs that track an index operate. It helps the fund stay true to its underlying index and adapt to market conditions. Keeping up with these changes, you know, can be helpful for investors.

You can always get the latest SCHD stock price, see its list of companies, and find recent news headlines from financial news sources. These updates are quite useful for staying informed about any significant events or changes that might affect the fund. It's like getting the daily news for your investments, so you are always in the loop.

Frequently Asked Questions About SCHD Stock

What is SCHD and what does it aim to do?

SCHD stands for the Schwab U.S. Dividend Equity ETF. Its main purpose is to follow, as closely as it can, the overall financial return of the Dow Jones U.S. Dividend 100 Index. This index, you know, includes 100 strong dividend-paying companies. The fund aims to give investors a way to get income from these companies.

Is SCHD a good option for passive income?

For many investors who want to receive regular payments from their investments, SCHD is considered one of the best ETF choices available. It focuses on companies that pay dividends, which can provide a steady stream of money. This makes it, you know, quite appealing for building passive income.

What kind of companies does SCHD hold?

SCHD holds a collection of stocks from various companies that are known for paying dividends. It recently added new stocks, especially in sectors like energy and financial services, which are often tied to economic cycles. You can view a full list of its holdings to see the specific companies it invests in. Learn more about dividend investing on our site.

Making a Decision About SCHD Stock

Deciding whether to buy or sell Schwab U.S. Dividend Equity ETF stock involves looking at all the information available. This includes its current price, its past performance, and what experts say about its future. It’s about gathering all the facts to make a choice that fits your personal financial situation and goals. You know, everyone's situation is a little different.

Considering SCHD for your investment portfolio means thinking about its role in providing income and its diversification compared to other funds. It’s a tool that can help you achieve certain financial objectives, especially if you are looking for regular payments. Always remember to do your own research and consider what works best for you. Discover more investment strategies to help guide your choices.

- Outback Dinner Menu With Prices And Pictures

- Nicole The Challenge

- Syracuse Womens Basketball

- Ishowspeed Amy

- Sarah Brown Actress

SCHD: An ETF Pursuing Stable Dividends and Growth Simultaneously

Schd Stock - Global Press Times

SCHD Stock Overview - Paxton Holden